DeFi derivatives. Good, bad & ugly

The article focuses on the increasing popularity of synthetic assets and liquid tokens in DeFi. Synthetic assets are token derivatives that can represent various assets, while liquid tokens allow users to trade and earn rewards from their assets that are locked or staked in different DeFi protocols.

Blockchain technology and cryptocurrencies present an alternative option to the traditional financial system. TradFi provides many investment solutions, from spot markets to advanced derivatives. The crypto ecosystem is constantly growing and introduced various innovative yield possibilities and subsidiary products imitating traditional finance. This article provides an overview of decentralized finance derivatives focusing on the opportunities they offer and the associated risks and misconceptions.

Derivatives types

TradFi has an impressive collection of contracts suited for every occasion and every investor or trader. The long history of financial markets led to the creation of derivatives with complex financial engineering involved. So complicated at times that it can result in a global crisis. 2007-2008 is the prime example. Mortgage-backed securities (MBS) are derivatives created by pooling together mortgages into a single security, later sold to investors. The interest and principal payments made by the individual borrowers are then passed through to the MBS holders.

During the 2007-2008 financial crisis, many of these MBS were created using subprime mortgages - loans made to borrowers with poor credit histories or high debt. In addition, they were given misleading high ratings (AAA). When the housing market began to crash, and interest rates began to rise, many subprime borrowers could not meet payments, leading to a wave of defaults. Banks and other financial institutions felt the consequences of MBS value decrease, which they invested in heavily. The resulting losses and liquidity problems ultimately contributed to the global financial crisis. TradFi lost tons of credibility in the process.

As the first successful blockchain experiment emerged in 2009 in the form of Bitcoin, the crypto ecosystem is very young in comparison. However, DeFi allows for fascinating experiments and tinkering with known solutions. We can currently distinguish five main categories of crypto derivatives: futures and perpetual contracts, options, leveraged tokens, synthetic assets, and liquid tokens. However, be open to new possibilities the vibrant DeFi ecosystem brings in the future. The first futures contract for a digital currency - BTC - was introduced in December 2017. It is trading on Chicago Mercantile Exchange (CME), and investors can go through brokers to purchase and sell contracts. Since then, crypto derivatives spread to altcoins even, offering leveraged instruments, which increases their potential risks and rewards. Options are now often available on cryptocurrency exchanges and platforms such as Deribit. Leveraged tokens are products with built-in leverage mechanisms like BTCUP and BTCDOWN.

In the following sections of the article, we will concentrate on the last two categories: synthetic assets and liquid tokens, as they are the main types on the rise in DeFi. Synthetic assets refer to token derivatives on a blockchain that can represent anything with a price. They can be in the shape of fiat currencies, cryptocurrencies, stocks, and commodities. Liquid tokens are a broad class of derivatives allowing for staked or locked underlying tokens to remain tradable. Users can earn rewards from their assets while still being able to trade, transfer, or utilize their holdings in different DeFi protocols.

Synthetic assets

Financial instruments created to resemble the value of other assets but have changes in basic features are referred to as synthetics. They are digital assets tracking the price of real-world assets (RWA) and cryptocurrencies. Users can attain exposure to various products without holding the actual underlying asset. Synthetix is the pioneering project in the crypto space regarding derivative tokens. Its native token SNX is the collateral for minting synthetic assets. Newly issued substitutes are called Synths.

The tokenization of RWA took off in 2021. More and more assets from traditional finance were created on a blockchain. New projects appeared, providing derivatives on different networks and filling out every possible gap. Synthetix offered sTSLA stocks, commodities sXAU and sXAG (gold and silver), and fiat currencies such as sUSD, sEUR, and sCHF. In addition, users were able to mint many different cryptocurrencies as sXXX. The problematic year 2022 significantly reduced the offering due to decreased demand. Even the biggest cryptocurrency exchange - Binance - started to provide tokenized stocks for its users. Tesla, Apple, and Coinbase stocks were available. Synthetics took over CeFi and DeFi, but it did not last long, and eventually, after a few months, regulators forced entities trading unregulated equities to end such practices.

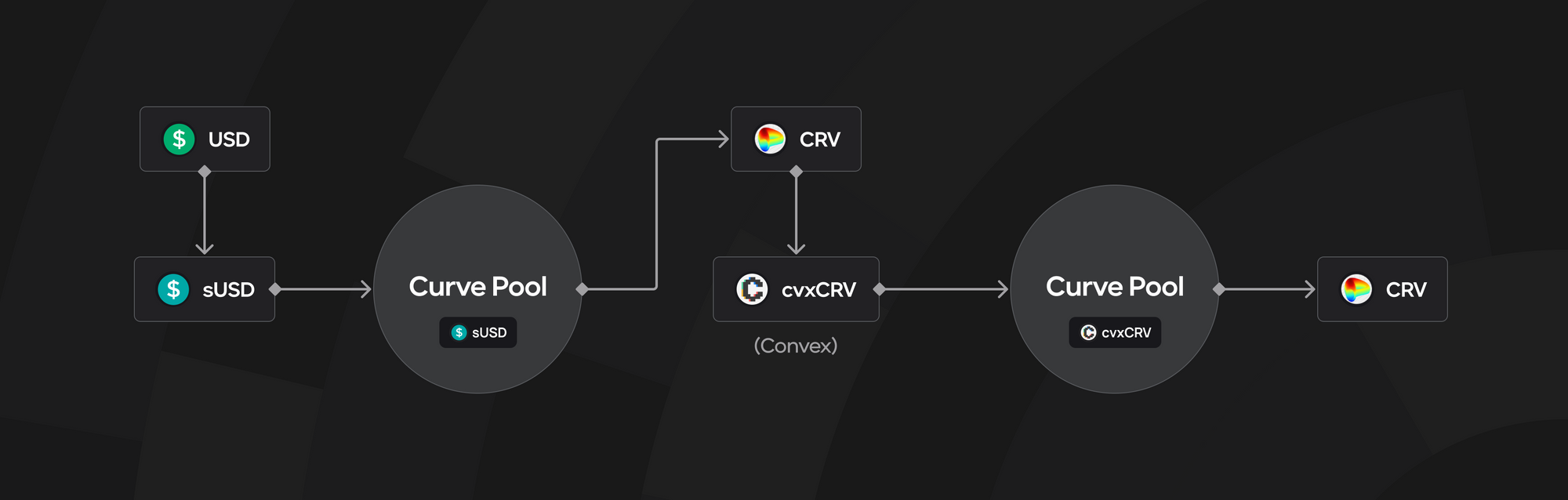

Synthetics are still in use, especially from Synthetix. The variety is just smaller. The biggest and most popular Synths survived. They are frequently used in DeFi investment strategies and often occur in crypto passive income programs. Curve Finance offers multiple DeFi pools. Curve is a decentralized exchange liquidity pool on Ethereum designed for efficient stablecoin and altcoin trading. People who wish to earn a yield on their assets such as USD, BTC, or ETH can mint or buy equivalent synthetics and provide liquidity on Curve Finance. They are rewarded for their share in the pool and incentivized with additional CRV tokens. The strategy can be upgraded by later staking CRV on Curve or engaging other DeFi protocols such as Convex Finance. To make it even more advanced, exchanged cvxCRV (Convex CRV) can be used again on Curve in a different pool. Users have total freedom and can make as complex strategies as they wish. The exemplary pathway to utilize owned assets via Synths:

DeFi participants have almost unlimited possibilities regarding sophisticated cryptocurrency utilization. Destinations represent DeFi marketplaces and loan protocols, custodial and non-custodial staking providers. All it takes is a basic understanding of Web3, token transfers, and non-custodial wallets. Getting acquainted with the reward mechanism of every protocol is recommended to know what we are signing for and not be surprised. It is essential to recognize the risks related to each DeFi pool or platform and leverage resulting from the next steps in the investment strategy. Risks and possible problems with synthetic assets will be described later in the article.

Synthetic assets are one of the ways forward for TradFi in the future. Although, they will not be called like this then. Tokenized securities are on the radar of financial institutions and permissioned DeFi platforms. The tokenization of traditional financial instruments, such as stocks and bonds, can enhance inclusivity and liquidity across the capital markets. As blockchain technology becomes more widespread, companies are discovering the advantages of converting their equity shares into a digital form. Tokenized equity has emerged as a straightforward way for businesses to secure funding by issuing shares as digital assets, such as tokens or coins. Synthetics may enter revenue-based financing, global money markets, and credit marketplaces.

Liquid tokens

Liquid tokens act as receipts and refer to cryptocurrencies locked in staking. The method of participating in a proof-of-stake (PoS) blockchain network while maintaining the liquidity of one's assets is called liquid staking. It is a crypto branch in rapid development and has gained popularity in the last months.

It all mainly revolves around the Ethereum network and cryptocurrency ETH. The Merge and Ethereum's transition from proof-of-work to proof-of-stake consensus mechanism created an entirely new ecosystem of liquid staking derivatives (LSD). Because ETH holders participating in securing the network are locking their assets, the market for allowing tradability emerged. Decentralized finance leaders in this field include Lido, Rocket Pool, and Frax Finance.

ETH liquid staking is vastly popular in CeFi, with exchanges such as Coinbase, Kraken, and Binance playing a significant role. In addition, the big market share is assigned to non-custodial staking providers. Liquid staking unlocked massive amounts of capital. It can be utilized in hundreds of DeFi pools and protocols.

Staking assets conventionally earn yield, but with enhanced liquidity, users can apply different strategies to multiply their rewards. LSD are available on the most recognizable blockchains to suit every enthusiast's needs and preferences. Derivatives can be easily tradable on Layer-1 and Layer-2 networks thanks to integration on the biggest decentralized exchanges such as Uniswap, Curve, or PancakeSwap.

Let's look at one corresponding case to synthetic assets out of many possible. Only stakers' imagination and risk exposure limit strategies' complexity. Initially, to earn rewards as an ETH staker, people had to become validators and stake 32 ETH. Now, the selection of CeFi and DeFi solutions exists to overcome hurdles for non-technical users or people who do not have the time or resources to run a validator node. They need only to decide how much custody over the funds they wish to give to third-party entities.

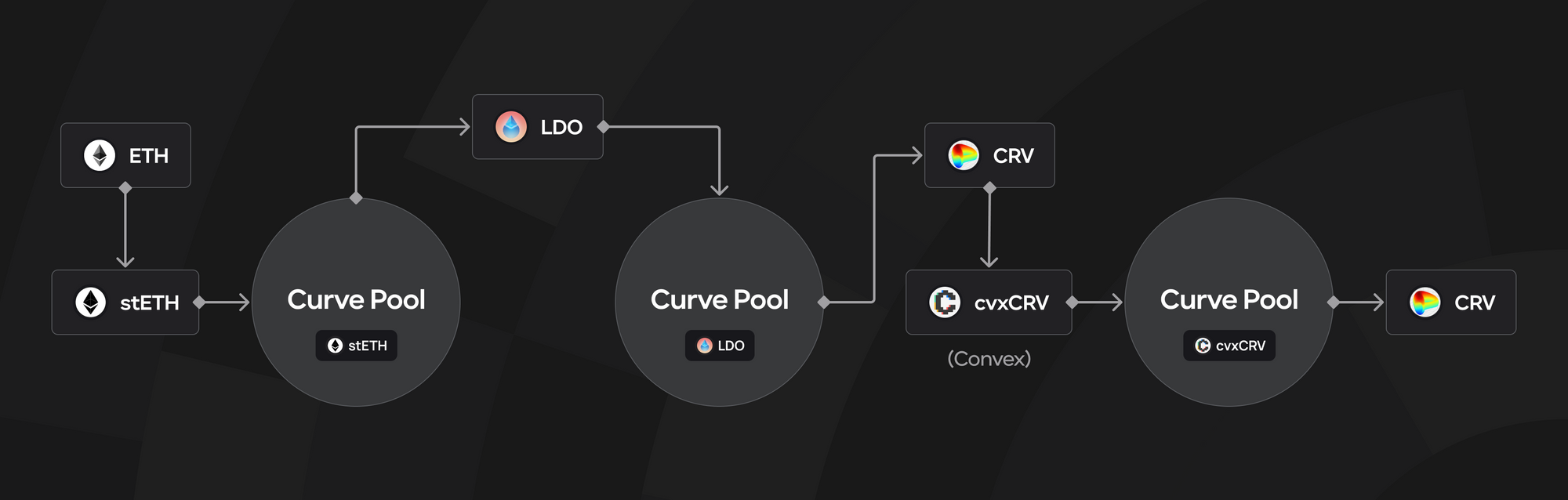

The typical strategy starts with ETH and staking it through Lido - the biggest non-custodial ETH staking provider. Users stake tokens and receive daily rewards. In exchange, they obtain stETH, a liquid version of ETH, which can be used across DeFi and bring additional yield. Next, staked Ether can get to protocols such as the previously presented Curve Finance or other decentralized exchanges where people can provide liquidity to specific token pairs.

Doing so on Curve, for example, users can get extra rewards in other cryptocurrencies like CRV and LDO. Later, as in the case of synthetics, they can generate additional yield. See the example below to grasp the possible result of elaborate DeFi strategies.

ETH staking is relatively modest percentage-wise in comparison to other blockchains. The share of ETH deposited to a staking smart contract is 13.9% at the time of writing. In contrast, Polkadot has 47.3% DOT supply staked, and Cosmos native token ATOM has a staking ratio of around 63.2%. Although Ethereum has a small number, the value of staked Ether is equal to $26.7 billion, and liquid staking derivatives count for 31.3% of that, according to Dune Analytics. As the staking ratio increases, LSD market share will witness massive capital inflows.

Other cryptocurrencies have liquid staking as well. It is not for ETH only. Polygon, for example, and native token MATIC can remain tradable thanks to several DeFi protocols such as Lido or Stader Labs. Holders of DOT or BNB can benefit from liquid staking too. Utilizing it and providing liquidity to specialized protocols can grant us entrance to lending and borrowing markets. Staked tokens act as collateral for borrowing. Navigating loans can result in additional capital, which can be spent on other cryptocurrencies. Ultimate crypto and DeFi degens leverage that by borrowing funds and adding them as collateral, increasing the loan limit. They borrow again and repeat this loop reaching the maximum yield with a small liquidation margin. It is definitely not for everyone, and a lot depends on the protocol's stability and sustainability.

The great advantage of liquid tokens comes in handy in case of any price decline, hacks, or crashes. Because standard staking forces locking assets, holders suffer losses with every market correction. When unstaking or unbonding tokens may take a few days or weeks, people who opted for LSD can exit their positions. All of this may be perceived as an additional level of security, but as mentioned in the following section, it may only compensate for the risks.

Bad & ugly

DeFi provides plenty of opportunities for people to earn a crypto yield. Synthetic assets and liquid staking derivatives lead the way in financial engineering. However, eye-catching annual percentage rates (APR) come with a price. Risk management and assessment are crucial for everyone participating in DeFi marketplaces, staking pools, or becoming a crypto liquidity provider.

Each step, staking, using different protocols, and providing liquidity involve additional risks. Security and stability should be first in mind when using any DeFi protocol. The code becomes responsible for vulnerabilities. Smart contracts need to be audited and exploit-resistant. The price correlation between underlying assets and derivatives is essential for synthetic assets and liquid tokens. The peg needs to be preserved, and oracles must provide proper values. The derivatives creator's stability makes your assets secure and redeemable. People need to be aware that DeFi is still unregulated, and any funds recovery is practically impossible in case of a platform collapse or hacks. Finding the balance between gains and increased leverage and risk is vital.

Even though liquid staking offers the tradability of assets, some derivatives may have low trading volumes and remain illiquid, making it hard to sell them at a fair price. Regulation, as always, might impact staking as a whole with the latest crackdown happening in the United States. It is good not to get unintentionally in trouble because of not being familiar with local regulations.

The following matter was mentioned a few times already in the article, and that is leverage. Along with financial risks, technical risks grow as well. By adding further protocols to the loop, users endanger themselves. Compounded stability of each platform determines the overall security of assets.

DeFi lending and borrowing might be tempting. However, people need to be aware of extra responsibilities related to crypto loans. Borrowing power is based on provided collateral (unless the protocol uses crypto loans without collateral, and e.g., imposes KYC), and users need to monitor the value of it not to get liquidated. Liquidation typically results in the loss of funds or a portion of them. Regular check-ins are recommended to verify loan details. In addition, borrowed assets come with costs, and the position acquires the interest, which later needs to be repaid.

Conclusion

In conclusion, DeFi derivatives such as synthetic assets and liquid tokens are valuable and useful for several reasons. It allows holders of staked assets to earn rewards while simultaneously retaining the ability to use and trade their assets as needed. This can be especially attractive for investors who want to maintain liquidity while also earning a passive crypto income.

Liquid staking also helps to increase the security and decentralization of the blockchain network, as it encourages more participation from validators helping prevent the centralization of staked token supply. Additionally, liquid staking can reduce the risks associated with standard staking, such as long lock-up periods and the potential for slashing, while still offering many of the benefits of staking.

While there are risks associated with DeFi protocols, these can be managed with proper research and risk management strategies. Overall, derivatives have the potential to bring many benefits to the crypto ecosystem and are an area that is likely to continue to grow in popularity in the coming years.

About us

Earn Network Marketplace will aggregate various yield opportunities, including liquid staking. It concentrates on the liquidity and tradability of users' assets without restricting their funds. Earn Network is focused on developing a marketplace for centralized and decentralized lending and staking. It aims to link both institutional and individual liquidity providers and borrowers. Earn Network provides a smart contract infrastructure to connect capital globally. Stay tuned for more!