Never get liquidated on your loan - Introduction to delta-neutral collateral backstop

Today, we will discuss the upcoming, new Lending category that is going to be launched on the Earn Network platform soon. In this article, I want to demonstrate how we pioneer the delta-neutral collateral backstop on a mass scale.

Lending on the Earn Network

The Lending category presents vast possibilities for creating a wide variety of loans. Participants in the community have the flexibility to choose from a diverse range of blockchain-supported assets, customize their repayment schedule, APR, collateral composition and other key parameters, offering nearly limitless options for loan structures.

In-depth explanation

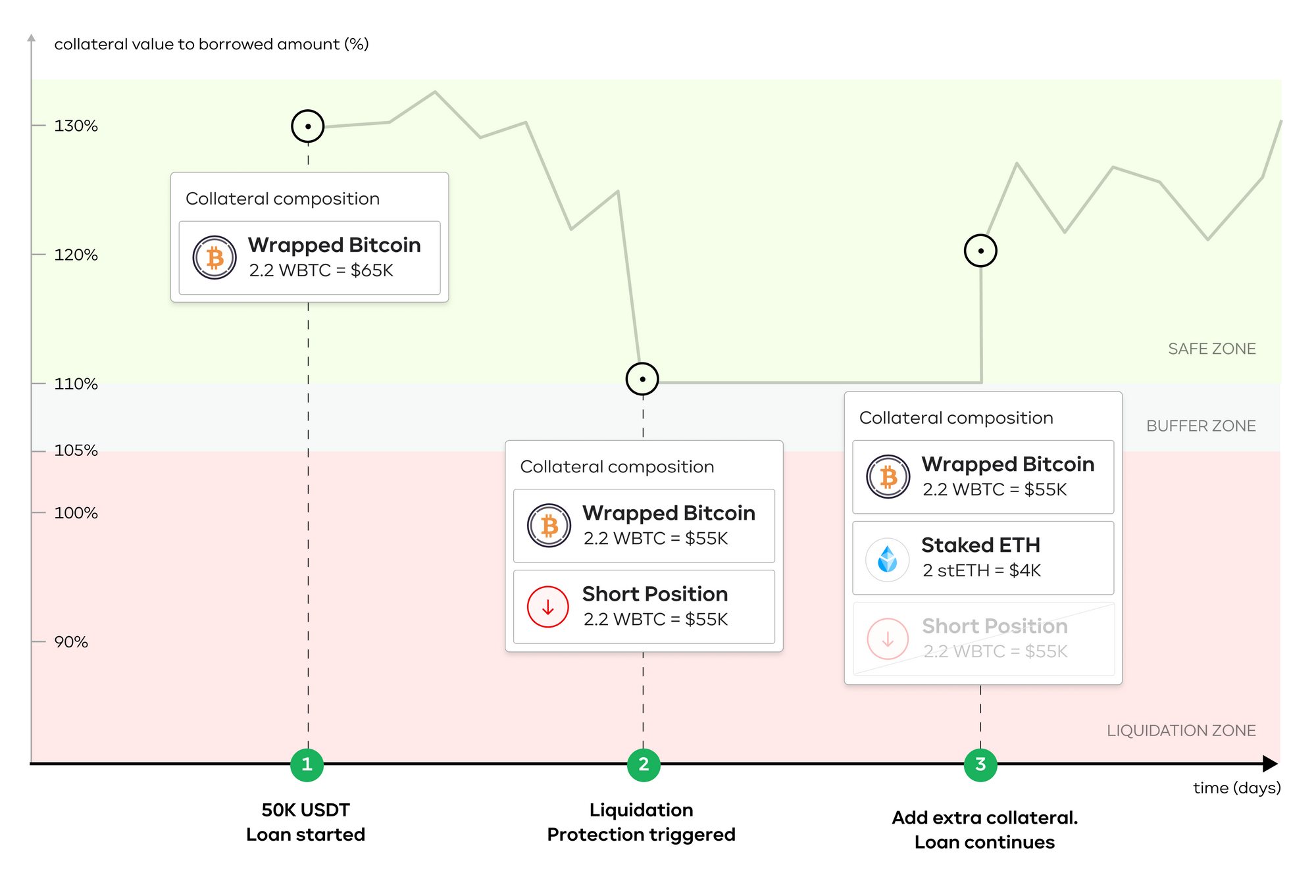

We will use the following image to demonstrate our example of someone that decided to borrow $50,000 USDT.

1. $50,000K USDT loan started

A user collateralizes a loan with 2.2 WBTC. At the time, t1, 2.2 WBTC are worth $65,000 (130% of the borrowing amount). We’re in the safe zone when it comes to our loan.

2. Liquidation protection triggered

Shortly after that time, t1 the WBTC value goes down. The loan-to-collateral ratio steadily drops. At the time of t2, the value of WBTC drops such that the loan-to-collateral ratio is only 110%. We’ve just entered the buffer zone. At this moment of time, t2 we will automatically issue you a put option / short leveraged token that would make your collateral delta-neutral. The liquidation protection now allows you to have enough time to deal with your collateral. Moreover, your loan continues and is not affected.

3. Add extra collateral to continue

You have now time to assess your collateral. You can now effectively add more assets including liquid tokens, LSDs & LP shares as they can be used at once as collateral. In our scenario, we add 2 stETH to bring back the collateral to the safe zone and close the short position / put option of the loan.

Benefits of Liquidation Protection

- Preserve your good score and reputation as a Borrower. One of the most important aspects on any marketplace is your reputation/score. This score will very likely determine if people will invest in your loan or how fast they will fill in liquidity to your future pools. Having at least 1 event on your loan liquidated (effectively not paying interest to your lenders) can put your reputation in danger.

- More confidence and choice to use various tokens and derivatives as collateral, while still being able to capture their potential upside. One additional innovation that the Earn Network is introducing is the ability for anyone to utilize their liquid tokens, LSDs & LP shares as a collateral. Having certainty that they won’t be liquidated when their value goes below the liquidation threshold (105%) will provide you with the needed protection. This is a very important aspect, especially for the tokens on which you’re already earning yield, e.g. stETH gives you ETH rewards.

- Worry-free lending during volatile markets. Monitoring various markets everyday and every hour to assess your collateral values may not be the most suitable option for everyone, especially across multiple loans. By having a certain backstop, that will be triggered when your collateral drops to 110%, gives you confidence that your loans can be dealt with at any given time when needed.

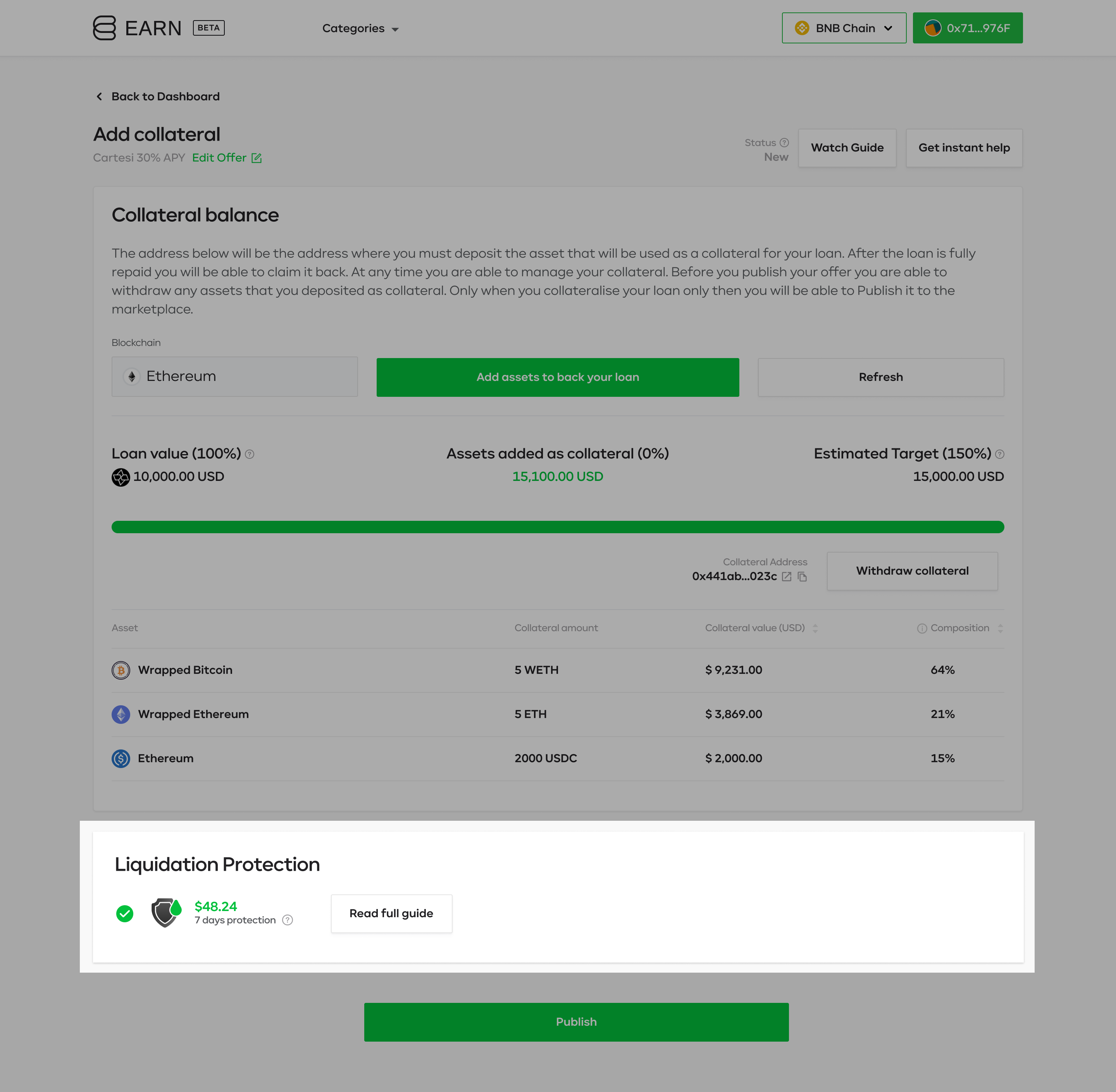

User experience on the platform

We strive to make our platform as easy to use as possible, not only for the advanced users but beginners alike. Here’s a work-in-progress example of how our Liquidation Protection will look like on the platform. The screen below demonstrates the step when you back your loan with various types of digital assets. At the bottom, you will see the element where the user is able to opt-in to buy Liquidation Protection.

Conclusions

We hope you enjoyed this article. If you think there could be any further improvements to this topic let us know in the comments below. Otherwise, we’re warmly inviting you to start your journey by visiting earn.network.