The Rise of Peer-to-Peer Crypto Lending: A New Era of Borrowing and Lending

Peer-to-peer (P2P) lending has become an increasingly popular alternative to traditional lending. With the emergence of cryptocurrency, P2P crypto lending platforms have gained traction as a way to offer loans with lower interest rates and faster approval times. In this article, we will delve into P2P crypto lending platforms, how they operate and how Earn Network Lending is different.

What are P2P Crypto Lending Platforms?

P2P crypto lending platforms are online marketplaces that directly connect borrowers with lenders, eliminating the need for intermediaries like banks. These platforms use blockchain technology to facilitate loan transactions, resulting in faster approval times, lower fees, and greater transparency.

How Do P2P Crypto Lending Platforms Work?

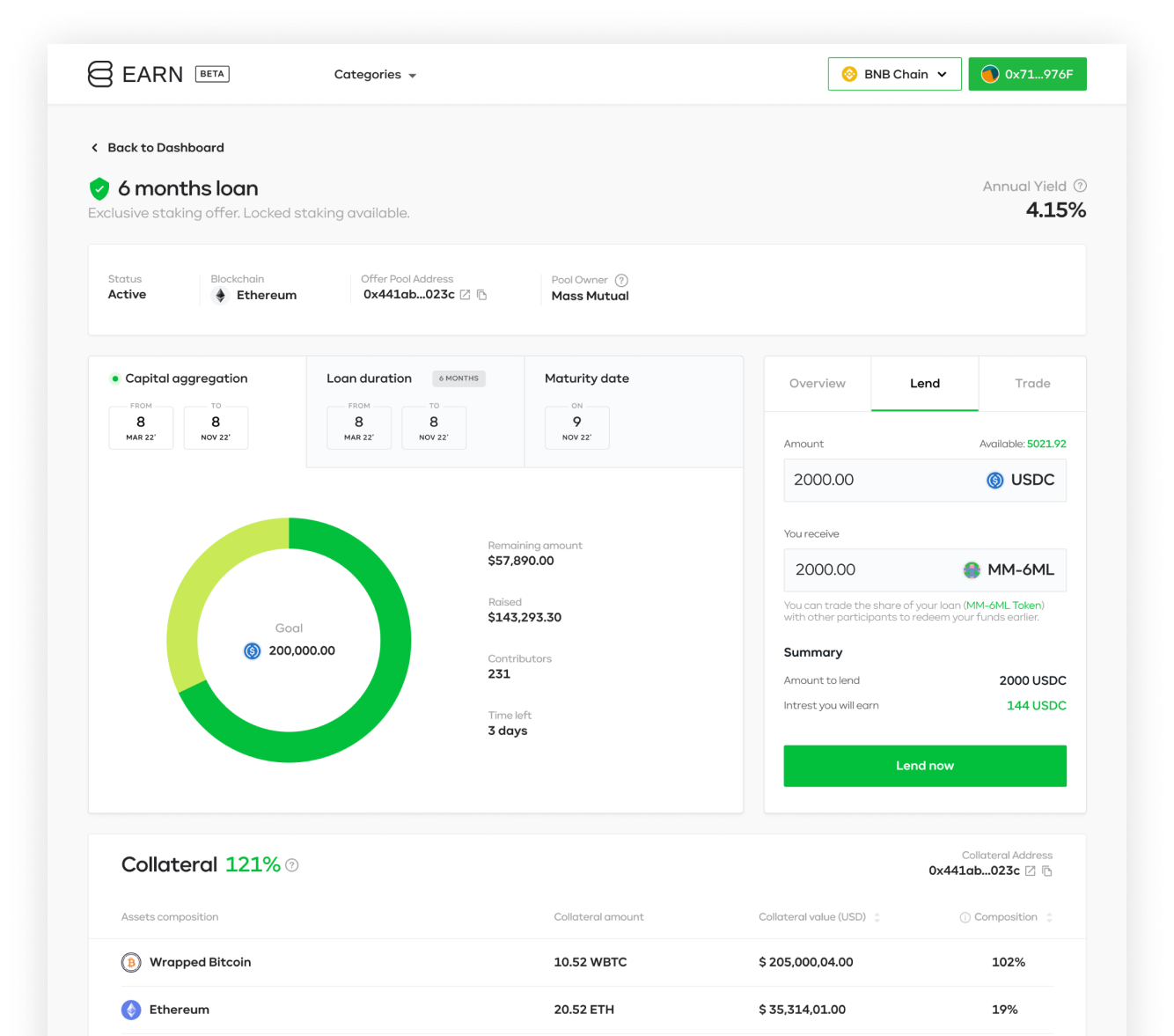

P2P crypto lending platforms work by creating a network of lenders and borrowers who interact directly with each other. On the Earn Network platform borrowers can request loans by creating a pool on the platform with its dedicated settings and parameters (asset, interest, repayment duration...). Lenders can then review loan details and choose to fund loans based on their risk tolerance and investment goals.

Once a loan is filled, the funds are transferred to the borrower’s pool. The borrower is then responsible for repaying the loan along with interest to the lender. Note, in case of Earn Network all pools will be collateralised at the start by Borrowers.

Benefits of P2P Crypto Lending Platforms

Lower Interest Rates: These platforms often offer lower interest rates than traditional lending institutions, which can help borrowers save money on interest payments.

Faster Process Times: P2P crypto lending platforms use blockchain technology to facilitate loan transactions, resulting in faster approval times compared to traditional lending institutions.

Full Transparency: Blockchain technology ensures greater transparency in loan transactions, making it easier for borrowers and lenders to track their investments.

Increased Access to Credit: These platforms offer borrowers access to credit who may not have been able to obtain loans through traditional lending institutions.

24/7 access : P2P crypto lending platforms and their participants can trade in crypto every day. You can request the loan on Saturday evening and have it filled in on Sunday morning.

No Too Big Too Fail Scenarios: Marketplaces rely on many participants contributing their funds to the pool as opposed to one institution filling in the entire loan. In case of unpaid loans the risk is spreaded across mutliple participants that don't posses systemic risk of a 'domino effect'

P2P Lending Market size

According to data from Statista, the global P2P lending market size was valued at over $67 billion in 2020 and is expected to reach over $558 billion by 2027. The Asia-Pacific region is the largest market for P2P lending, accounting for over 80% of the total market share. However, the United States and Europe are also significant players in the market, with the US accounting for over $19 billion in P2P loans in 2020.

The growth of the P2P market can be attributed to several factors, including the increasing adoption of digital technologies, the growing awareness and acceptance of alternative financing options, and the increasing demand for small business loans. P2P lending has also become an attractive investment option for individuals seeking higher returns, with some platforms offering annual returns of over 10%.

Introducing an open financial marketplace driven by the community

Earn Network marketplace is a revolutionary platform with amazing experience and simple to use interface. It's a place where:

- Both Businesses and Individuals can easily access funds by creating their custom funding pools (setting duration, asset, allowing deposit from only verified users...).

- Diverse range of asset (300+) is supported. Such range will unleash arbitrage creativity of many DeFi yield hunters.

- All pools must be collateralised at the start. No risk for liquidity providers.

Stay tuned for more. We will be updating you with new posts. As of today an estimated beta launch of lending is scheduled for July 23'.